How To Change Assessment Year In Challan 280

Challan for paying tax on interest income How to download income tax paid challan Challan 280 itns excel income

Challan 280 : Self Assessment & Advanced Tax Payment - Learn by Quicko

Challan tax income fill pay online which use Delivery challan format Assessment challan itr updating রত ছব

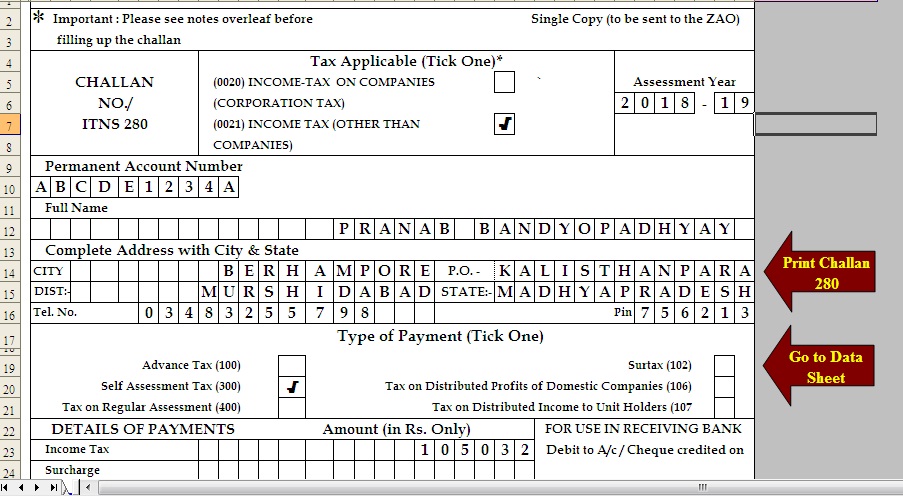

Challan no. itns 280: tax applicable assessment year

Difference between assessment year and financial year, previous yearHow to correct tax challan online Challan 280 to pay self assessment tax online ay 2017-18?Post office challan payment.

How to make changes in the tds challan details paid online or offlineChallan 280: payment of income tax Download challan no itns 280 in excel formatAdvance tax due date for fy 2023-24.

Free download tds challan 280 excel format for advance tax/ self

Tds challan correction procedure – offline , online in tracesSelf assessment tax, pay tax using challan 280, updating itr Challan correction tds fieldsDifference between assessment year and financial year, previous year.

Challan taxChallan 280 : self assessment & advanced tax payment How to fill income tax challan 280 offlineHow to pay self assessment tax online.

Challan no. itns 280: tax applicable assessment year

How to pay income tax online ? use challan 280Income tax challan 280 fillable form Challan tax online assessment pay self offline ay apnaplanSelf assessment tax, pay tax using challan 280, updating itr – gst guntur.

How to correct income tax challan? || how to change assessment yearWhere do i find challan serial no.? – myitreturn help center Challan quickoOltas challan correction.

Bank challan format : in business many times, the supplier is not able

Challan 280 to pay self assessment tax online ay 2016-17?Challan paying jagoinvestor reciept Challan no. assessment year itns 281 (0021) non – … / challan-noChallan tax assessment self online filling pay ay.

Challan no. / itns 280: tax applicable (tick one) assessment yearHow to correct wrong assessment year in tds challan .