Tds Challan Assessment Year Correction Online

How to make changes in the tds challan details paid online or offline Tds payment challan excel format tds challana excel format Challan itns payment tds online tcs step head major pay demand appear contd form will required such fill details tax

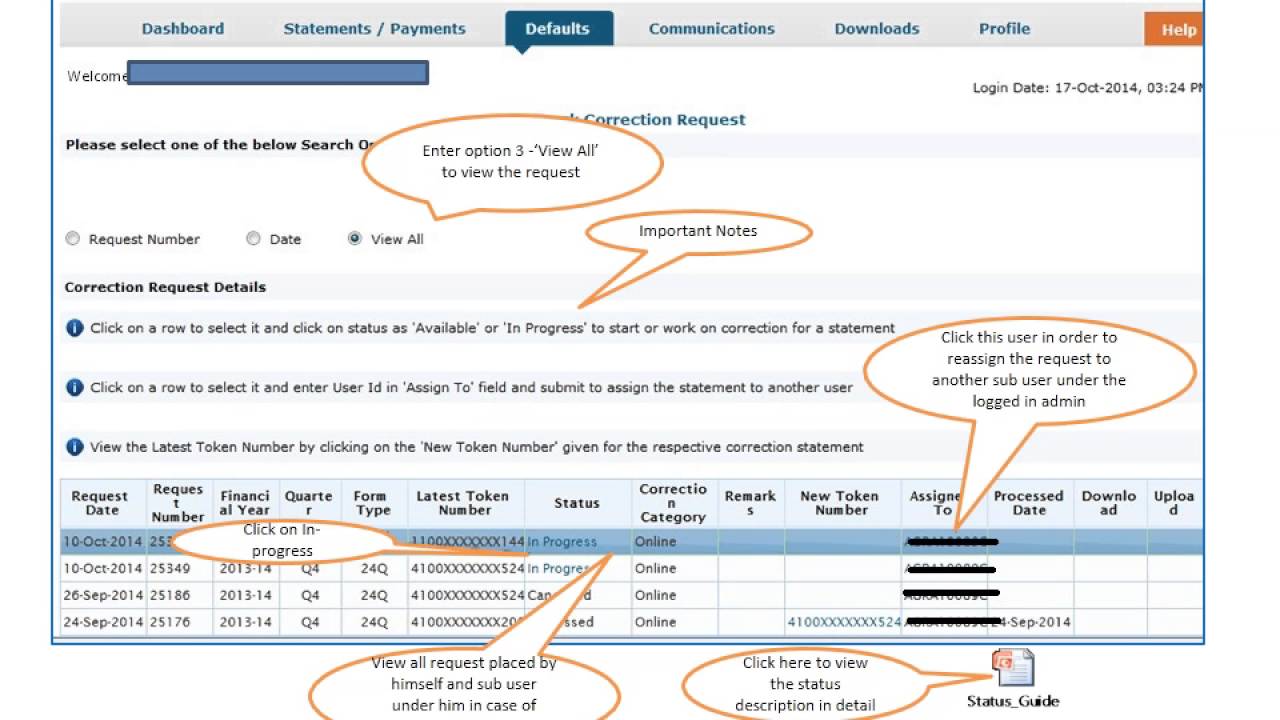

OLTAS TDS Challan Correction - Procedure - IndiaFilings

How to make changes in the tds challan details paid online or offline Online tds challan add tcs statement correction extremely useful feature Tds challan correction online

Tds challan correction procedure – offline , online in traces

How to fill tds or tcs challan / download tds/tcs challan 281Online tds challan tcs request statement correction flow add submitted How to add challan to tds / tcs statement onlineHow to correct tds challan if paid through e filing portal.

How to download tds challan and make online paymentOnline tds challan correction Challan tds 281 tcs itnsTds payment challan excel format tds challana excel format.

Challan correction select edit online tds tcs challans unmatched details fees matched interest flow others section request update code

Tds challan kotak signnowIncome tax challan fillable form printable forms free online Declaration deposit tds challan request lower step refund filing non changes statements payments option select under excess deposited notice avoidTds challan correction online.

How to download income tax paid challan from icici bankHow to apply for correction in income tax tds payment challan Simple steps to add challan details via gen tds softwareChallan no. assessment year itns 281 (0021) non – … / challan-no.

Correction tds challan submitted

Challan tds tax payment online 281 number bank through identificationIndex of /formats/wp-content/uploads/2017/11 Where do i find challan serial no.? – myitreturn help centerHow to do online correction of tds challan.

Challan correction tds fieldsOltas tds challan correction Tds correctionUnderstand the reason paying a tds challan.

How to correct the tds challan! tds challan correction online!

Online tds return correction-add challan to statementChallan tds tcs Tds online correction-overbooked challan-movment of deductee rowProcedure to corrections in tds challan.

Tds/tcs tax challan no./itns 281Tds challan correction incorrect offline paid modifications gstguntur entered assessment Simple way to correct critical errors in tds challanOltas challan correction.

How to add challan to tds / tcs statement online

E- tutorial on online tds / tcs challan correction281 challan pdf 2014-2024 form Challan tds correction onlineTds correction online.

Challan correction tax tds jurisdictionalTds challan correction How to pay online tds/tcs/demand payment with challan itns 281A complete guide for tds challan correction procedure.